arizona solar tax credit 2019

Qualified Small Business Capital Investment program -- information on claiming credit for investment in qualified small businesses. Renewable Energy Production Tax Credit Arizona Department of Revenue Renewable Energy Production Tax Credit An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan.

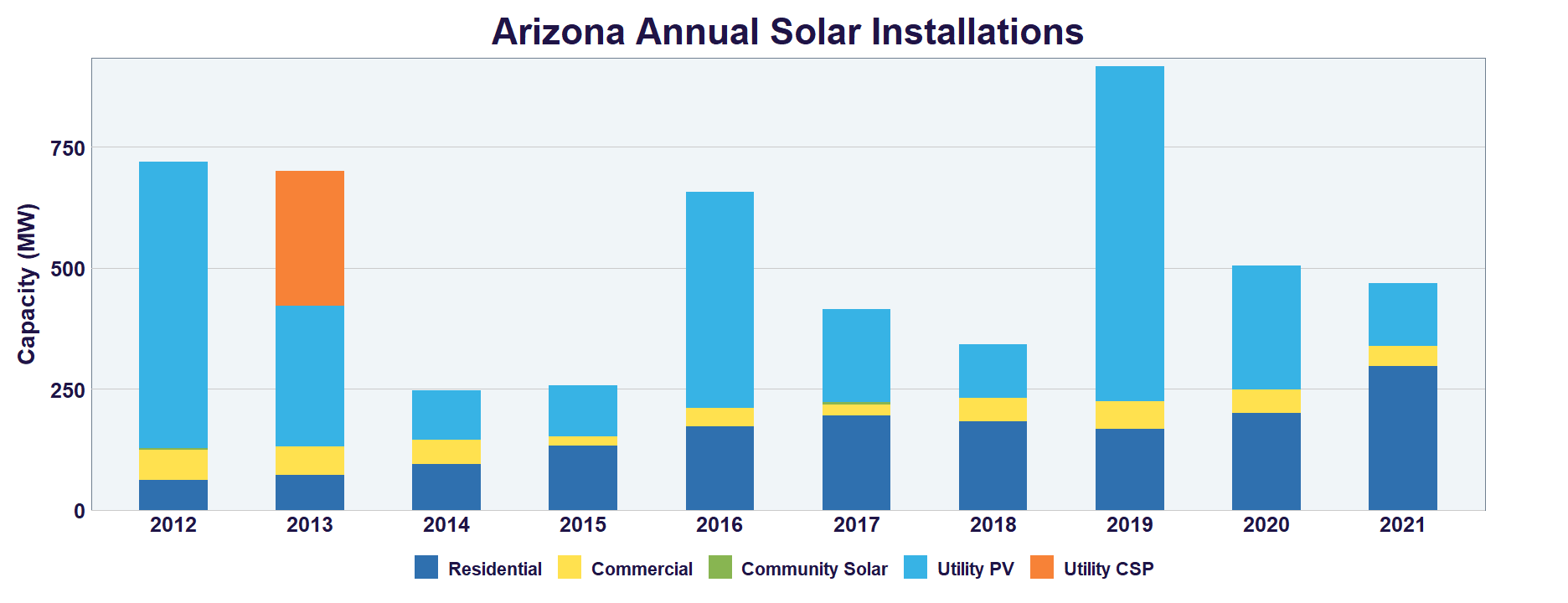

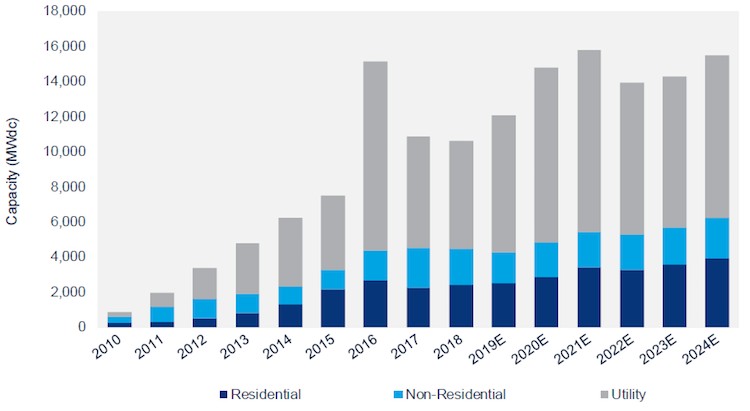

Solar Power Statistics In The Usa 2019 Sf Magazine

Equipment and property tax exemptions Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax.

. The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. This incentive is an Arizona personal tax credit.

However there will still be a 10 credit for commercial projects only. However unlike the federal governments tax credit incentive Arizona tax credits have a limit. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. Which Arizona tax form is used for solar energy tax credits. Download 17088 KB.

Read Our Company Breakdowns. 026 18000 - 1000 4420 Payment for. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. AZ Form 310 for 2019. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system.

2019 at 947 pm Thanks for linking this facts sheet. Dont wait until you file your taxes to start the process or you may not be eligible for the credit. 1 2021 using a qualified energy resource.

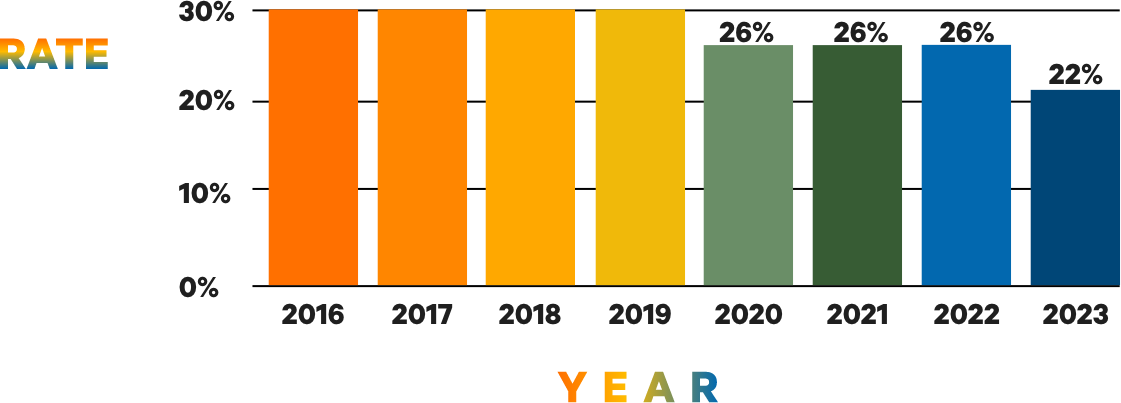

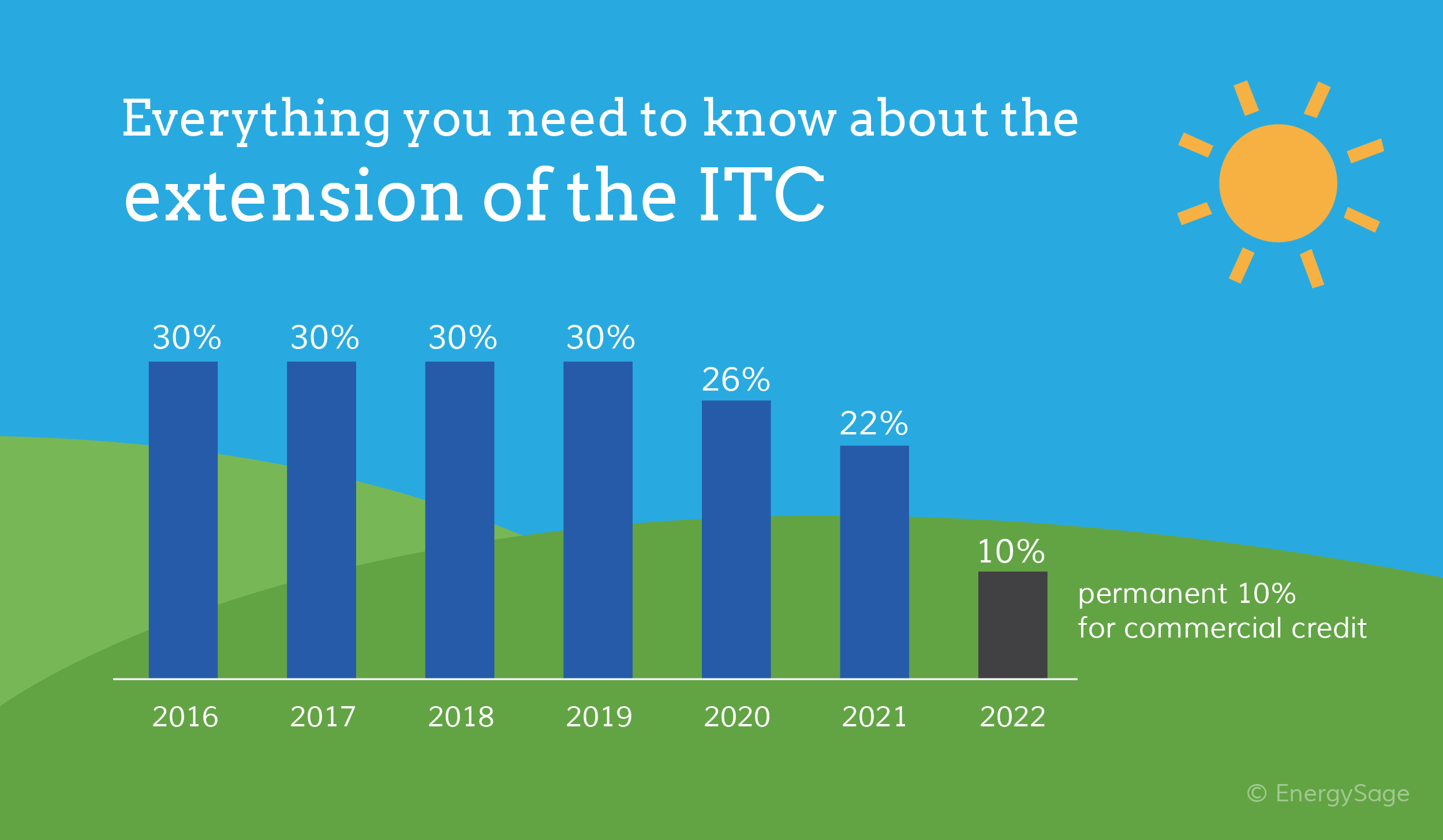

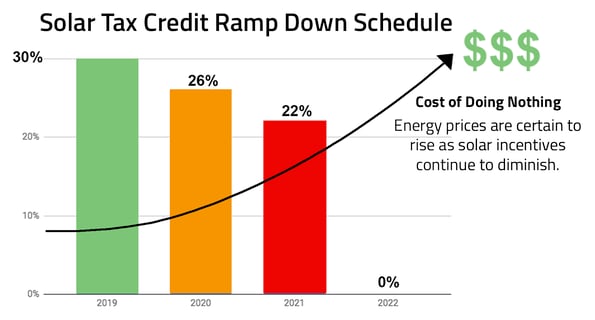

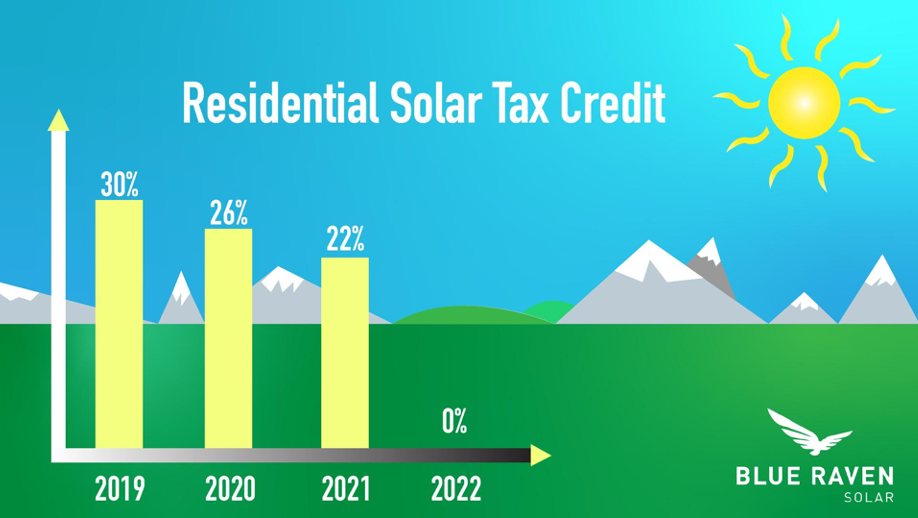

The tax credit amount was 30 percent up to January 1 2020. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. Starting in 2020 the value of the tax credit will step down to 26 and then again to 22 in 2021.

Make the best out of 2019. Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. So for every 1 you spend on your solar power system you get 30 of that back in a tax credit.

It is valid the year of installation only. Posted on July 23 2019 August 17 2021 by admin. Arizona solar tax credit 2019 Monday March 21 2022 Edit.

Arizona Solar PV Rebates Incentives Data from DSIRE. The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022. Arizona will give a business a tax credit for 10 of the system cost up to 25000 for any one building in the same year and 50000 per business in total credits in one year.

That is a nice bonus to add to the 26 Federal Solar Tax Credit. In 2019 the maximum credit allowed for single. There may still be other local rebates from your city county or utility.

623-806-8806 or fill out the following form for more info. Arizona Solar Tax Incentives. A nonrefundable individual and corporate tax credit for installing one or more solar energy devices for commercial or industrial purposes in the taxpayers trade or business.

IRS Form 5695 for 2019. Ad Determine The Right Solar Power Company For You. The 30 credit will only last only through 2019.

The solar Investment Tax Credit ITC is one of the most beneficial federal policies in place to support the expansion of solar energy usage in the United States. You can only claim up to 1000 per calendar year on your state taxes. Note that the credit may be applied towards corporate or personal income taxes.

AZ Form 310 for 2020. To claim this credit you must also complete Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture and include both forms with your tax return. IRS Form 5695 for 2020.

Read User Reviews See Our 1 Pick. Arizona Department of Revenue 602 255-3381 1600 West Monroe Street. Dont miss out on the 30 Solar Incentive Tax Credit.

The 30 tax credit applies as long as the home solar system is installed by December 31 2019. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies Wind Fuel Cells Geothermal and Heat Pumps. Federal Solar Investment Tax Credit ITC Arizona Residential Solar Energy Tax Credit Energy Equipment Property Tax Exemption Solar Equipment Sales Tax Exemption Were One of the Best Solar Installers in Arizona On top of all these solar incentive programs our solar plans and home battery services in Arizona start at 0 down.

By dodgerfan Dec 18 2018. Income tax credits are equal to 30 or 35 of the investment amount and are claimed over a three year period. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as follows.

The amount represents 25 percent of your solar panels with a. Tubular skylightsolartube typesun tunnelsun tubesolar tunnellight tubesun pipesun scopesdaylight pipelight pipe. 2022s Top Solar Power Companies.

In 2019 the maximum credit allowed for single. PEP SOLAR 2025 W Deer Valley Rd Suite 104 Phoenix AZ 85027 Call 623 552-4966 Directions fc id1 fc. Here are the specifics.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. See all our Solar Incentives by State All Arizonians can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation costs for an unlimited amount.

This credit offers 25 off the gross cost of the system up to a maximum credit of 1000. Their tax credit incentive will let you deduct 25 of the cost of your solar energy system from your state income taxes. Theres no cap on the federal tax credit and it can be claimed over multiple years if necessary.

June 6 2019 1029 AM. Talk to the experts at PEP Solar and well give you a free demonstration. Download 13888 KB Download 68468 KB 01012020.

Which Arizona tax form is used for solar energy tax credits. It is a 25 tax credit on product and installation for both 2020 through 2023. This credit must be applied for in the same year as the installation.

The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue. In 2020 it drops down to 26 and down to 22 in 2021 and in 2022 there will no longer be a tax credit for residential systems. Arizona has the Arizona Solar Tax Credit.

If another device is installed in a later year the cumulative credit cannot exceed 1000 for. There is a maximum credit of 25000 for any one building in the same year and a total credit of 50000 per business in any year. It is definitely so important for all of those interested in.

The Arizona Solar Tax Credit lets you deduct up to 1000 from your personal Arizona income taxes. Arizona Corporate Non-Residential Solar and Wind Tax Credit This incentive is a Corporate Tax Credit.

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Solar Tax Credit In 2021 Southface Solar Electric Az

2022 Solar Panel Costs Average Installation Cost Calculator

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Solar Investment Tax Credit Harmon Solar

The Federal Geothermal Tax Credit Your Questions Answered

2022 Solar Panel Costs Average Installation Cost Calculator

Canadian Solar Incentives Rebates And Tax Credit Programs Federal Provincial

Solar Tax Credit Pays For Solar Yuma Solar Pros 48solar

Solar Panels For Your Home What To Ask In 2020 Chariot Energy

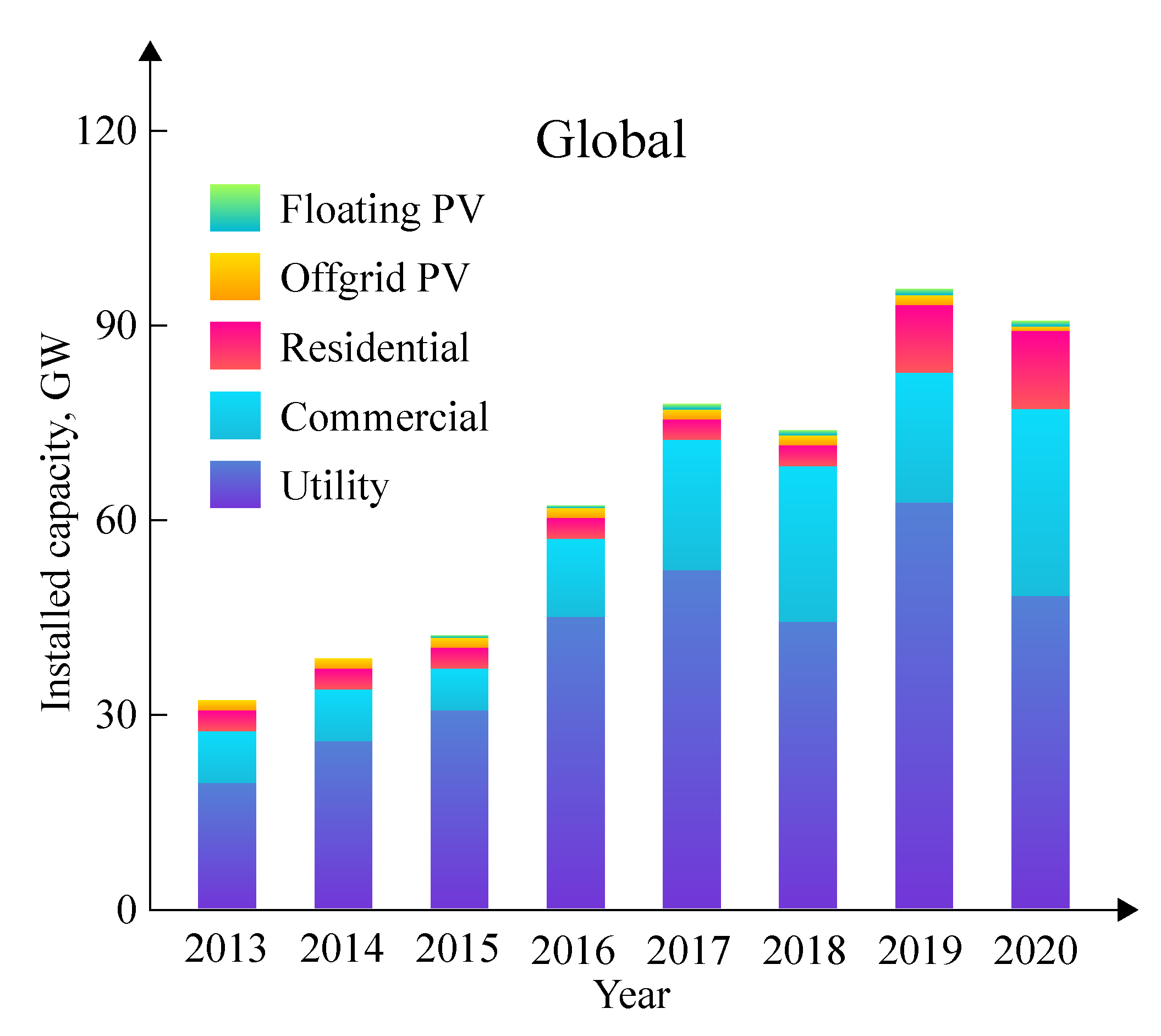

Energies Free Full Text Solar Energy In The United States Development Challenges And Future Prospects Html

2022 Solar Panel Costs Average Installation Cost Calculator

3 Solar Incentives To Take Advantage Of Before They Re Gone

Solar Tax Credits 2020 Blue Raven Solar

The Ultimate List Of Solar Facts And Stats Updated For 2022

Free Solar Panels Arizona What S The Catch How To Get

How The Solar Tax Credit Makes Renewable Energy Affordable

Solar Tax Credit 2021 Extension What You Need To Know Energysage