capital gains tax changes 2022

7 rows Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes. New tax laws for capital gains are also in place in 2022.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Currently the capital gains tax rate for wealthy investors sits at 20. 500000 of capital gains on real estate if youre married and filing.

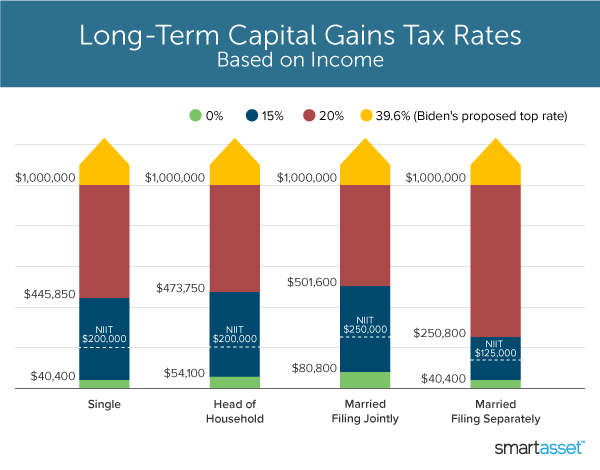

If you realize long-term capital gains from the sale of. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. The AFP and Green Book also note that noncorporate entities like partnerships and trusts would be required to recognize gain on unrealized.

There may well be some form of change to Capital Gains. Key changes for individuals. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property.

When you include the 38 net investment income tax NIIT and some state income taxes you could be looking at a 48 all-in capital gains tax rate by January 1 2022. 4 rows If you sell stocks mutual funds or other capital assets that you held for at least one year any. Free easy returns on millions of items.

Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income. This means youll pay 30 in Capital Gains. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

Free shipping on qualified orders. If your long-term capital gains take you into a higher tax bracket only the gains above that threshold will be taxed at the higher rate. Read customer reviews find best sellers.

The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. Be aware of key changes and new measures when completing your clients 2022 tax returns.

Key changes for companies. Although the capital gains tax rates for long-term investments which are those youve held for at least a year remain the same in 2022 the income thresholds have been. The proposal is bumping.

Qualified dividend income shall not include any amount which the taxpayer takes into account as investment. There is a change on the horizon which can take place as soon as 2022. The rate jumps to 15 percent on capital gains if their income is 41676 to.

Ad Browse discover thousands of brands. The IRS typically allows you to exclude up to. 4 rows Capital Gains Taxes on Collectibles.

One final note on changes to capital gains. Capital Gains Tax is currently charged at a flat rate of 18 for basic rate taxpayers. Capital Gains Changes in 2022.

For single tax filers you can benefit. 250000 of capital gains on real estate if youre single. Capital gains are treated as ordinary income and taxed at the normal rate.

For example if you have a stock with a capital gain and sell it prior to one year its a. The Washington Capital Gains Tax Changes Initiative 1934-1938 may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8. Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million. While there are no sweeping federal tax changes taking effect in 2022 there are several. For single taxpayers and married individuals filing.

The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. In other words if your long-term capital. RD Credits for Gaming Manufacturing Agriculture Architecture Engineering Software.

Are the tax rates changing for 2022.

Trust Tax Rates And Exemptions For 2022 Smartasset

How To Pay Zero Taxes On Capital Gains Yes It S Legal Youtube In 2022 Capital Gain Capital Gains Tax Tax

When Do You Pay Capital Gains Tax On Real Estate In 2022 Capital Gains Tax Employment Report Capital Gain

2022 And 2021 Capital Gains Tax Rates Smartasset

2021 Capital Gains Tax Rates By State

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax What Is It When Do You Pay It

What S In Biden S Capital Gains Tax Plan Smartasset

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Taxes On Selling A House In Texas What Are The Taxes To Sell My Home In 2022 Property Tax Property Valuation Estate Tax

Capital Gains Tax Advice News Features Tips Kiplinger

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe